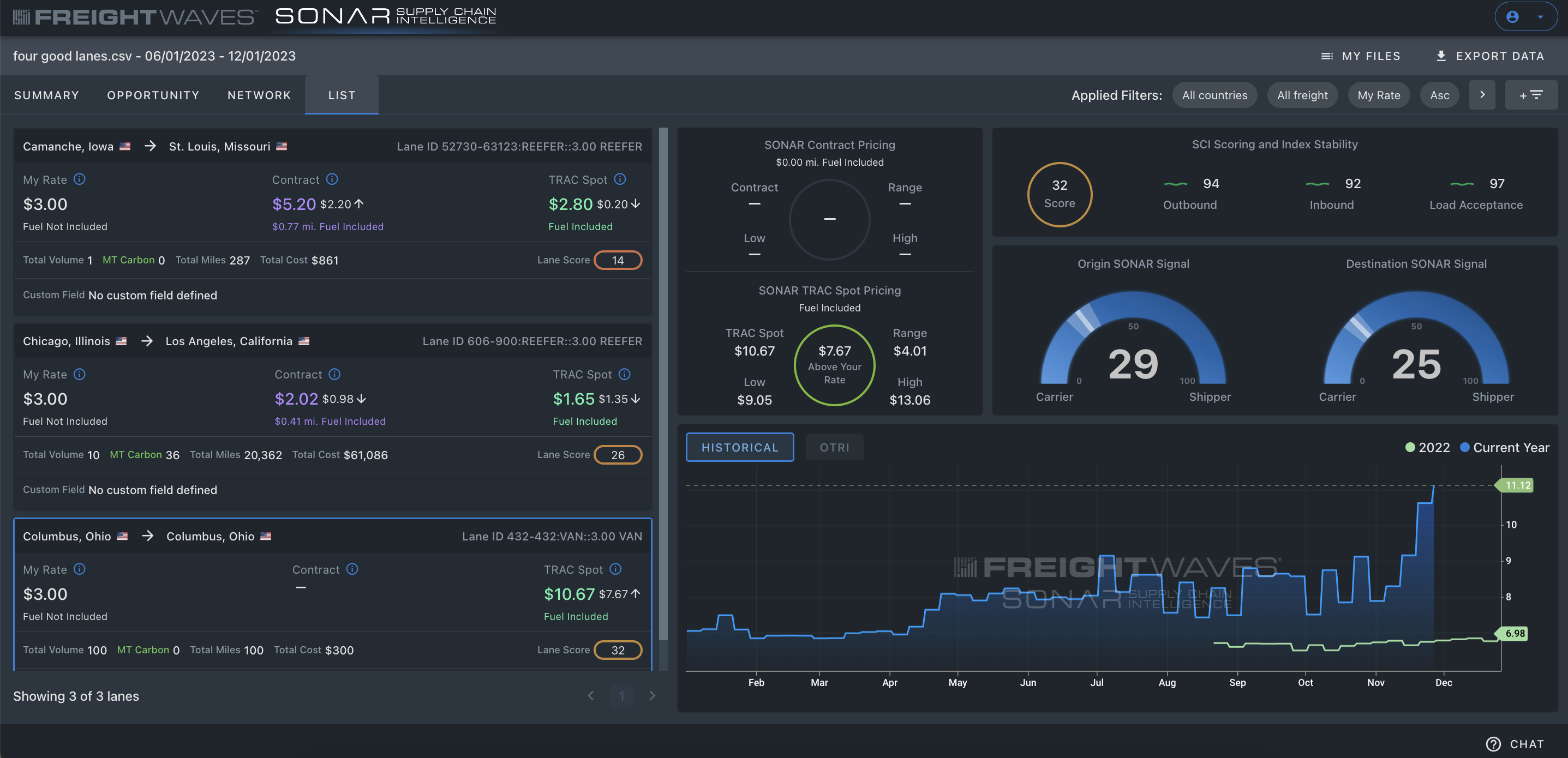

SCI provides insights into market stability, by lane, helping participants identify TRAC Spot and Contract rates and capacity risk on a lane. It also gives users the ability to quantify the carbon impact of their transportation networks.

This tool also provides a measure of lane coverage favorability via the Lane Score, which evaluates multiple data points within the app. Think of it as a volatility score for a given lane, throughout the year, determined by historical tender activity and rate volatility. The higher the stability score, the more consistent the rate and capacity are on a given lane, resulting in a consistently high rate of tender acceptance. The lower the stability score, the more likely a given lane will experience routing guide instability.

The scores, analytics, & insights in SCI come from a combination of tender activity, TRAC Spot rate consortium and historical contract rate transactions. The contract rate data has been collected over a 4 year period from a pool of $80 billion worth of actual paid contract rate invoices.

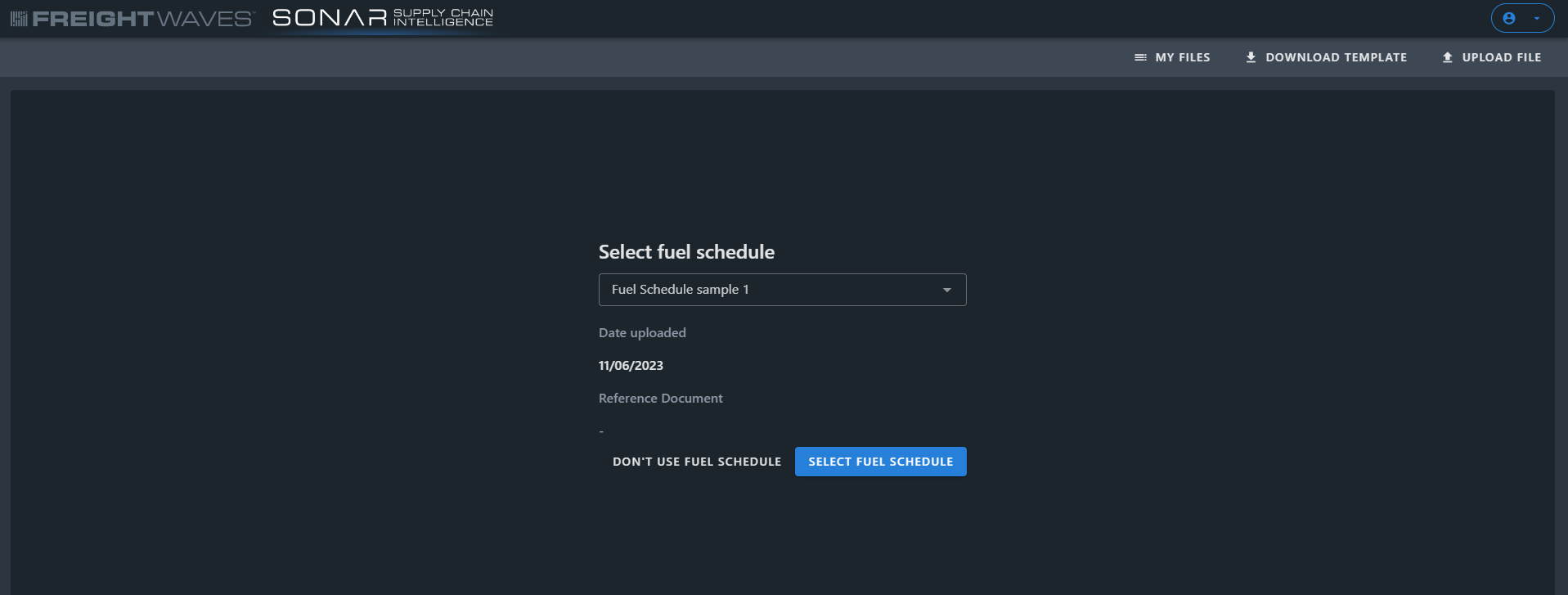

Fuel Schedules :

Fuel schedules are meant to provide users with the ability to incorporate custom fuel surcharges into their rates when doing a benchmark analysis of their lanes.

Selecting a Fuel Schedule

SCI accurately predicts when and where routing guide failures are likely to occur.

SCI shows multiple benchmarking, volume and rate across a set series of lanes based on historical paid invoicing data and real-time data. This lane-level intelligence provides insight into specific markets, origin/destination stability and contracted/spot rates to inform short-term RFPs, networking decisions, identify the most actionable lanes where CO2 emissions can be reduced and more. This combined helps enterprises identify issues within existing bids, recognize the contributing factors affecting lane stability, apply seasonality and accessorials.

SCI generates more strategic improvement goals, particularly mini-bids and capacity procurement, by the continued use of tactical (in-action) moves versus strategic (pre-planned) moves across the unified, digital and collaborative transportation network. Now, users can upload their data to tap SCI insights day or night. Additional implications include RFP strategy, knowing when to onboard new carriers, new lanes, hire more drivers or plan next distribution center sites.

This tool further provides current insight into the Historical Truckload Rate Data via the visual ticker and the current Outbound Tender Rejection Index for that specific lane’s origin.

The video below will give you a step by step tutorial on how to fill in the template for SCI.

For the full SCI 101 tutorial – please click here.